Here’s a year end roundup (aka The Wonky Awards) from Ezra Klein’s Wonkblog at The Washington Post. While wonky indeed, he’s presented it all in such a way that even we economically illiterate get the drift. It’s a terrific piece of work and challenges much of the conventional narrative, but don’t expect any corrections in the media script – plain facts aren’t sexy.

This one strikes me as the most revealing example of media failure – every time a politician or partisan warns we’re going to become Greece!!!, the punditocracy ought to use this information to inform any discussion.

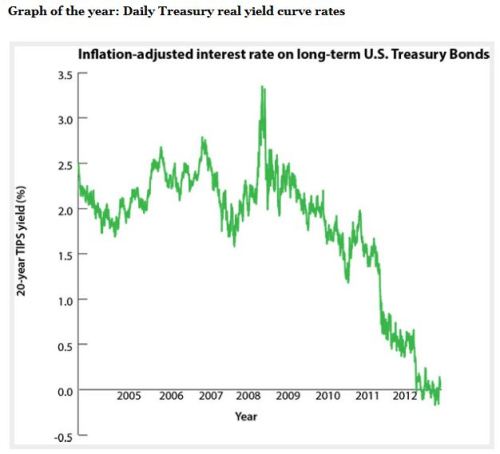

As we endlessly debated deficits and debts this year, every so often it was worth surfing over to the neglected corner of the Treasury.Gov Web site where they track the inflation-adjusted yield on government debt. Those quick jaunts were always a good reminder that everyone in politics was completely insane.

The thing you worry about when you have high deficits is that the market will lose its confidence in your ability to repay your debts. The place you’d see the market losing its confidence is in high interest rates on government debt — that would be a signal that the market is pricing in some risk of default. But all this year, the real yield on three- , five- , seven- and, occasionally, even 20-year government debt has been negative. Negative! The world is so dangerous that the market will literally pay us to keep their money safe.

If any corporation could borrow for less than nothing, they’d see that as the opportunity of a lifetime. We can borrow for less than nothing at a moment when our infrastructure is crumbling and millions are out of work. But instead of taking advantage of this amazing opportunity, we’re actually cutting our support to the economy and arguing exclusively about how to reduce our deficits. It’s embarrassing.

It is a common theme among Keynesian macroecononomists (Now THERE is a mouthful) that record low Treasury yields are proof positive Keynes is right and that government needs to be spending more money, not less to revive the economy. It is Paul Krugman’s constant mantra.

That theme says that government debt doesn’t matter. No matter how much there is, it can always be mitigated with central bank monetary policy.

There is truth in it, to. If the entire $16.4 trillion National Debt could be refinanced at under 2% we should do it in a heartbeat right today. That is below bargain basement borrowing rates. It makes the cost of borrowing the lowest its ever been.

But even that is a two-edged sword.

The entire Social Security and Medicare trust finds are tied up in Treasury securities. The low yields mean those accounts aren’t making anything at all for the Americans who depend on them. That is accelerating those trusts’ headlong plunge into inevitable insolvency.

It defies common sense to grow debt indefinitely without consequence. The world isn’t always going to be in deep financial trouble. That is the reason for the low Treasury yields right now.

As the economy of the world and the U.S. recover, Treasury rates will inevitably start going up again.

———————————————

An oversimplified exercise:

The historical 110-year average yield for U.S. Treasury bonds is 4.9%.

Assume for a moment that the world and U.S. economy improves over the next 4 years under Obama’s Presidency. Conservatively assume the Treasury rate rises back up to 4% by then, still well below its historical average.

(Treasury rates were as high as 6% as recently as the year 2000)

In fiscal year 2012, the interest cost to service the national debt was $360 billion. Tax collections were around $2.3 trillion.

The National debt by 2016 will be $20+ trillion. At 4%, the yearly interest cost will rise to $800+ billion/yr.

What programs do you think will have to be cut to pay that interest?

LikeLike

azleader, I don’t actually disagree with you here. The debt is a problem and the futue deficit is worse. But the debt is something that will go down almost automatically if the economy improves. So, as Krugman, and so many others say, the debt needn’t be addressed in the short term because there’s really no logical way to do that. Medicare – or more properly health care – is an enormous problem and will kill us if we don’t face up to it. Private insurance costs are going up too fast and Medicare’s obligations face demographic doom. So, big problem.

Soc Security on the other hand is self financing,, or at least is designed to be. And with minor tweaks, it should be just fine for at least another quarter century. We did it in the 80’s and it worked. Time to do it again. But the program is sound and it is not our problem.

By the way, last year David Frum, Republican from Bush’s administration, , asked his readers this:

“Imagine, if you will, someone who read only the Wall Street Journal editorial page between 2000 and 2011, and someone in the same period who read only the collected columns of Paul Krugman. Which reader would have been better informed about the realities of the current economic crisis? The answer, I think, should give us pause. ” By ‘us’ I think he means his fellow Republicans.

Nice to see you back and Happy New Year!

LikeLike

Coming late to comment on this post, I know, but it’s excellent, Moe, as are Azleader’s comments. And perhaps it’s timely that I comment late because I am just now hearing mostly rosy reports about economic recovery in the evening news, particularly in the car and truck business, in the energy sector, in healthcare, and in disaster recovery (hurricane recovery funds being finally and grudgingly approved by GOP curmudgeons). All across the country Mitt’s 53% must be (secretly) relishing their new-found feelings of prosperity. So much for the cliff, eh? Curses! The enemy Obama is winning!

Azleader asks, “what programs will have to be cut to pay that interest?” In a perfect world I see the DOD (under new SecDef Hagel) drastically cutting unneeded Cold War programs in favor of anti-terrorism technology like the successful drones, completed withdrawal from Afghanistan (with a vow to stop nation-building), modest reforms of Social Security, Medicare and Medicaid, reform of the tax code to eliminate the black market economy, and the biggest one of all, adoption of a single-payer, not-for-profit healthcare system. If only!

LikeLike

A perfect plan Jim but far too logical to make any headway with our congress critters. And of course, a wider pool of insured would solve Medicare’s demographic problem – bring in the young’uns. That’s do it. (and its nevver too late!)

LikeLike